Discounted Cash Flow (DCF) Valuation: The Basics was originally published on Forage.

Discounted cash flow (DCF) valuation is a type of financial model that determines whether an investment is worthwhile based on future cash flows. A DCF model is based on the idea that a company’s value is determined by how well the company can generate cash flows for its investors in the future.

In this guide, we’ll cover:

- What Is DCF Used For?

- How Do You Do a Discounted Cash Flow Valuation?

- How to Show DCF Skills on Your Resume

- Related Skills

What Is DCF Used For?

A discounted cash flow valuation is used to determine if an investment is worthwhile in the long run. For example, in investment banking, a DCF valuation is used to determine if a potential merger or acquisition is worth it. Additionally, DCF valuation is used in real estate and private equity.

Outside of corporate finance, DCF valuations can help business owners make budget decisions and determine their own projected value.

Showcase new skills

Build the confidence and practical skills that employers are looking for with Forage virtual work experiences.

How Do You Do a Discounted Cash Flow Valuation?

A core principle of finance is that $10 today is worth more than $10 a year from now. This principle is the “time value of money” concept and it is a key basis for DCF valuation. Projected future cash flows must be discounted to present value so they can be accurately analyzed.

What Is the DCF Valuation Formula?

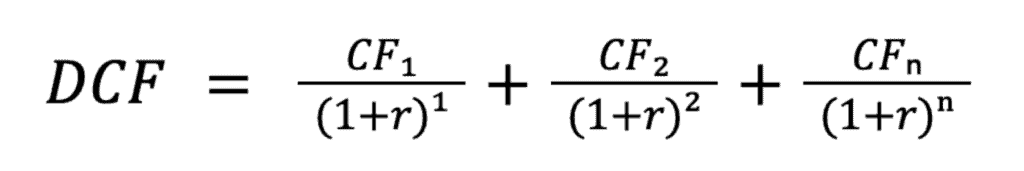

There are three main parts to consider when doing a DCF valuation: the discount rate, the cash flows, and the number of periods. The formula for discounted cash flow is:

Components of DCF

- CF₁ = Cash flow for the first period

- CF₂ = Cash flow for the second period

- CFₙ = Cash flow for “n” period

- n = Number of periods

- r = Discount rate

Cash Flow (CF)

Cash flow is any sort of earnings or dividends. These cash flows can include revenues from the sales of products or services or cash from selling an asset.

Number of Periods (n)

The number of periods is however many years the cash flows are expected to occur. Oftentimes, the number of periods is 10, or 10 years, as this is the average lifespan of a company. However, depending on the company itself, this period could be longer or shorter.

Discount Rate (r)

The discount rate brings future costs to present value. Typically, the discount rate is the company’s cost of capital, or how much the company must make to justify the cost of operation. This cost is usually the weighted average cost of capital (WACC), which is the company’s interest rate and loan payments or dividend payments to shareholders.

>>MORE: Learn if finance is a good career path.

DCF Valuation Example

Let’s say you have a company, and you want to start a big project. Your company’s weighted average cost of capital is 8%, so you’ll use 8% for your discount rate. The project is set to last for five years, and your company needs to put in an initial investment of $15 million. Cash flows for the project are:

- Year 1: $1 million

- Year 2: $2 million

- Year 3: $5 million

- Year 4: $5 million

- Year 5: $7 million

So, using these future cash flows and your 8% discount rate, your yearly discounted cash flows are:

YearProjected Cash FlowDiscounted Cash Flow*1$1,000,000$925,9262$2,000,000$1,714,6783$5,000,000$3,969,1614$5,000,000$3,675,1495$7,000,000$4,764,082*Discounted cash flow is rounded to the nearest whole dollar amount.

To determine if this project is a worthwhile investment, we need to compare the initial investment to the sum of the discounted cash flows over the lifetime of the project.

- Initial Investment: $15,000,000

- Discount cash flow sum: $15,048,996

- Net present value for project: $48,996

The net present value is found by subtracting the initial investment cost from the sum of the discounted cash flows. The net present value is a positive number, meaning that the money generated by the project is more than the initial investment. Ultimately, this project would be at least mildly profitable.

Learn how to calculate DCF for top investment banking companies with these programs:

- Bank of America Investment Banking Virtual Experience Program

- JPMorgan Investment Banking Virtual Experience Program

How to Show DCF Skills on Your Resume

Discounted cash flow (DCF) valuation is a type of financial modeling, and it is a common type used by many finance professionals. There are two key ways you can include DCF skills on your resume.

- Skills section: You can list “financial modeling” in your skills section. You can even include DCF, and any other types of modeling you are skilled in, alongside financial modeling.

- Work or internship experience section: You can mention an instance where you created a DCF model as part of prior work or internship experience.

Learn more ways to showcase your hard skills.

Related Skills

DCF valuation is a core skill for many finance professionals, including investment bankers. Some other useful skills include:

- Calculating the weighted average cost of capital (WACC)

- Using Excel

- Completing a comparables analysis

- Understanding debt capital markets

You can learn these skills (and more!) using Forage’s Investment Banking Skills Passport.

Image credit: videoflow / Depositphotos.com

The post Discounted Cash Flow (DCF) Valuation: The Basics appeared first on Forage.